in Jupiter, FL

Helping Your Aging Parent Move House After the Loss of Their Partner

Losing a partner can be devastating, especially after a lifetime spent together. It invariably leads to major life changes for the remaining partner. They may, for example, wish to move out of the home they shared with their spouse – maybe because they can’t maintain the place alone or they can’t deal with the memories. If that is the case with your parent, you may need to help them move elsewhere.

In this mini-guide, The Orrico Team explains how you could help your aging parent move after the loss of their partner, whether that means helping them buy a new house, downsize, or move to a rental:

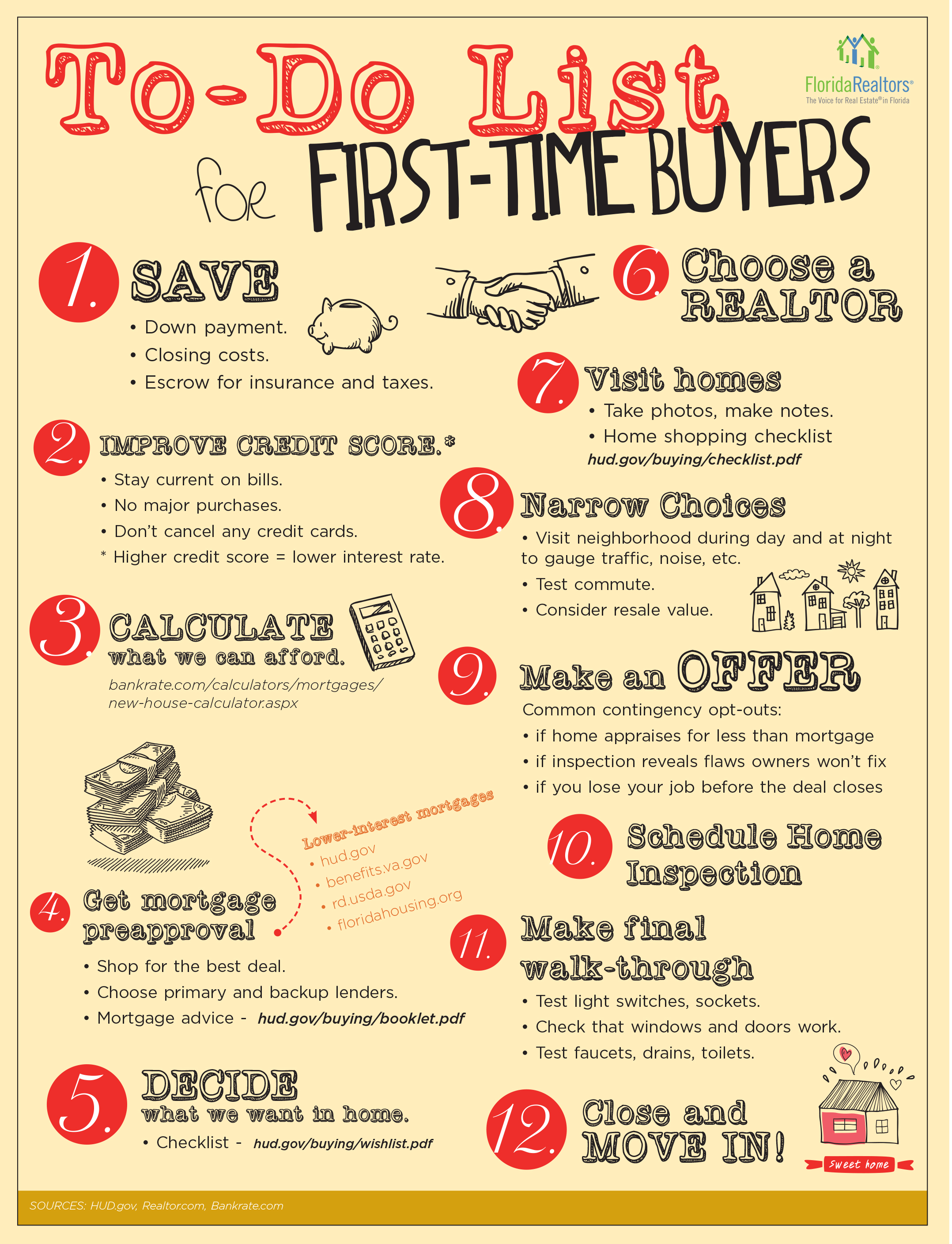

Figure out how much home they can afford

First, it’s a good idea to nail down a budget for the new home. Do they have any savings or investments? Do they own their current home, which can then be sold? Can they afford to buy a new home outright? Make sure you account for your parent’s living expenses, healthcare, and other miscellaneous expenses on top of the home budget. Chase offers a simple mortgage calculator if you’re planning to apply for a loan.

Consider how much financial help you wish to extend

Depending on your parent’s financial state, you may have to chip in with the cost of the new home. Some of your options, as explained by Investopedia, are cosigning your parent’s new mortgage, assisting with the down payment, or buying a home yourself and renting it out to them.

Get a mortgage pre-approved, if applicable

It’s a good idea to get a mortgage pre-approved. This will allow you to house hunt faster and close faster as well. Mortgages typically get pre-approved within a few business days. NerdWallet notes that the documents you need include income statements, assets, debt payments, and other records.

Consider the amenities your aging parent might need

Before house hunting, it’s a good idea to prepare a list of wants and needs. Consider the essential amenities your aging parent needs, now and in the future – like nearby healthcare, a garden, a quiet neighborhood, first-floor bathrooms and bedrooms, anti-skid tiling, fixtures, extra-bright lighting, and more. Most likely, you will have to modify a home after you purchase it to make it suitable for them to live in.

Make an offer and close

After you’ve found a home you’re both happy with, it’s time to make an offer. Once the final price is fixed, you have to finalize the loan, hire a home inspector, and finally purchase home insurance. It’s a good idea to inspect the house yourself – don’t ignore red flags like mold, structural problems, old wiring, and old plumbing.

Purchase a home warranty

Purchasing a home warranty will protect your parent, in case costly repairs are needed for home systems or major appliances that break down. The rates you pay are affected by your location, the credit and claims history, and the age and condition of the systems or items affected. Consider costs available in the local market before choosing a provider. When selecting one in Florida, take into account the coverage and benefits offered.

Pack and move

Next, you may have to help your parent pack. This may involve decluttering, getting their possessions sorted, and cleaning the old house. You may want to hire a professional moving crew to help with this. It will cost you some money, but professionals handle everything from packing to transportation.

Watch out for their emotional health

Losing a partner is not easy. They are grieving (you probably are too). Moving to a different place, away from their previous life, will make it that much harder. The whole experience may stress them out, make them depressed, and cause them to break down. There are things you can do to help them cope. But if they are showing signs of listlessness or have developed a sudden fascination for death, it’s time to contact a therapist.

Conclusion

You don’t need to take responsibility for the entirety of the move alone. You can also ask your friends and family for assistance. Please be aware that home buying can be a long-drawn-out process that can last several months. If you want everything to go smoothly and don’t want to miss out on important details, make sure you plan out your move ahead, including investing in a home warranty.

Image via Unsplash

The Orrico Team of Loggerhead Realty has been helping northern Palm Beach County and Martin County residents buy, sell, or rent their homes since 1990. Connect with us today for more info! (561) 707-6188

Turning Your Dream Home Into a Reality

Everyone has a dream home. Unfortunately, many people believe their dream home to be out of reach or too difficult to find. With some planning and help from the Orrico Team, you can turn your dreams into a reality.

Be Realistic About Your Expectations

To buy a house, you need to know how much you can afford ahead of time. Don't waste your time looking at homes that might be out of reach. To determine how much you can afford, take your gross monthly income and subtract your monthly expenses and debts. Your mortgage payment should not exceed 28% of your monthly income.

Closing costs are the final obstacle to climb before you own your new home. Generally, closing costs range from 2% to 5% of your purchase price, but there are ways to reduce them. If all else fails, you could have to purchase a less expensive home.

First, check the loan estimate form from your potential lenders. Some lenders will give you an estimate beforehand, and you can compare the closing costs from various institutions. You could also consider a mortgage with no closing costs. Keep in mind that no-closing cost mortgages have the costs folded into the loan. Additionally, you can sometimes negotiate with the seller to pay some of the closing costs.

Seek Guidance From a Professional

To find a suitable home, work with a real estate agent. The Orrico Team is up-to-date on the latest market trends and can help you find a house that fits your specific needs. Even if you're not moving far from your current location, you probably don't know every neighborhood. Our team can inform you of neighborhoods within your budget, near the best schools, and with the lowest crime rates.

They will also consider the following:

- Your hobbies and interests

- Your family's needs

- Your job location

In addition to helping you locate homes in suitable neighborhoods, they know how to negotiate with other homeowners. You don't want to work alone if you want the best possible deal on a house. Real estate agents network with various professionals within the industry. They can help you contact inspectors, maintenance people, and lenders.

Protect Your Investment

To protect your investment and to get the most out of your property, make sure you plan to stay in the home for a while. It might not be worth the loan if you don't plan to stay. You will want to pay down some of your home loan principal first. Additionally, make sure you know where you plan to buy your homeowner's insurance policy. According to the experts, most mortgage lenders require you to have homeowner's insurance that covers the home's structure. With the homeowner's policy, you might also want a home warranty.

A home warranty protects major appliances, plumbing, electrical, and HVAC systems. Don't confuse home warranty with homeowners insurance. Homeowner's insurance protects against perils, whereas a home warranty protects against wear and tear. Ask for a home inspection to check for red flags or any warranties on current appliances. You can then find out if it's worth it.

Your dream home might be within reach. As long as you research and seek a professional's guidance, it's possible to find a house that fits your budget and your plans for the future. Once you find the home of your dreams, learn how to lock it in.

Upgrade Your Home For A New Business With These Crucial Tips

Buying a new home is a pretty involved process because it comes with a long list of things to consider, and when you’re going bigger in order to start a home-based business, it’s important to make careful choices in order to ensure it’s the right property for both your personal and professional needs. That means you may need to research listings for a while before you find a good fit, and of course, it’s a good idea to work with a professional real estate team like The Orrico Team who can help you through the entire process.

Here are a few things to consider when you’re ready to upsize your home and start building your business:

Examine all your options

While handling any real estate transaction can be challenging and stressful, you can better manage the process if you examine all the options available to you. Not only will this help to reduce stress, but it will also ensure that you’re able to save money while choosing the best home for your needs. One route to go in is the “as-is” option, which means you can search for listings that are being sold with no repairs or promises from the seller.

The circumstances vary, from a home that’s gone into foreclosure to a seller who can’t afford to make repairs before they vacate, so an “as-is” home often needs a little work; however, the sellers are usually very motivated to get through the process as quickly as possible, which means you won’t have to wait too long before you take possession, and there are many home repairs and simple renovations you can make yourself. Just make sure you have the property inspected thoroughly, and consult with a lawyer who can examine the land deed and make sure there are no red flags that show up.

Take care of the legal details

Once you’ve found the perfect home in the best neighborhood, it’s time to focus on the business side of things. Whether you’re moving to the other side of town or to a new state entirely, you’ll want to make sure your new venture is protected, so it’s a good idea to look into the legal details as soon as possible. Setting up business insurance, registering your business, and creating a structure—such as a limited liability company—will give you peace of mind and will ensure that you’re ready to go when you get your work area set up in the new place. Look into the details of forming an LLC, particularly if you’re moving to a new state, as the rules vary around the country. You’ll also need to check and see if your city requires a special permit that allows you to run a business from your home.

Set yourself up for success

After gathering everything you need to protect your business and ensure that it complies legally, you’ll want to set up a stellar website that encompasses what you’re all about. Running a home-based business can be challenging when it comes to marketing simply because you have to bring customers to you without the benefit of a storefront that catches foot traffic. This means your site needs to be informative, secure, easy to navigate, and full of SEO tactics that will help customers easily find you during their online searches.

Having a great website won’t matter if you don’t get traffic, so try marketing on Facebook in addition to your SEO strategy. You can even create Facebook ads for free. Just start with a template that appeals to you. Then customize it with your choice of graphics, colors, and text. One you have a design you like, download it to use for your advertisements. Then you’ll be sure to get web clicks.

Buying a new home and starting a business at the same time can be tricky, but with a solid plan, you can sail through the process without breaking a sweat. Consider all your options, and work with the team of pros at The Orrico Team who can help you make the right decisions.

Tips for Settling Into a New Home After Retirement

Moving into a new home for your golden years is common for retirees. Whether you're downsizing, moving closer to family, or moving to Florida to soak up the sunshine, settling into your new home can take time. These tips from Loggerhead Realty can help you settle in quickly and happily.

Unpack Quickly

Unpacking can be tedious, but putting things away helps you feel settled. It also makes your new place feel like home and makes it easier to find what you need. You can hire an unpacking service to do the work for an easier transition.

Create an Inviting Outdoor Space

Jupiter, FL gets an average of 235 sunny days yearly and has an average low in January of 54 degrees Fahrenheit, so you'll want a great outdoor space to enjoy it. Consider adding a patio or pool if your new yard doesn't have one. Clean up the landscaping, and repair the deck or other features to make it more functional.

Make It Safe and Secure

Ensure your new home is safe, so you can feel at ease living there. Installing a home security system and smart home features gives you peace of mind and convenience. Make your home safer to prevent falls and injuries with the following tips:

- Light all areas well

- Remove tripping hazards

- Secure rugs to the floor

Take time to check all of your windows and doors, too, to ensure they close and lock correctly. If you find that anything is broken or not working properly, search online for “broken house window repair near me” or similar and get a professional working on it right away. Broken glass and an unsecured house are not safe.

Spruce Up the Kitchen

The kitchen is the heart of your home and is the perfect place to entertain new friends you make. Adding an under-cabinet range hood makes your kitchen cleaner and safer by removing grease, smoke, and odors for improved air quality. Replacing outdated countertops or cabinets spruces up the space. Add an island or pantry for more functional space. A minor midrange kitchen remodel comes with an average 72.2% return on investment, so it's a smart option.

Explore the Neighborhood

Get out into the community quickly to feel at home. Jupiter is one of the “Palm Beaches” and boasts incredible natural beauty. Join the eco-friendly residents on the almost 40 mile Jupiter Waterway Trail. Or visit the nearby Dubois or Jupiter Beach Parks for clear water perfect for swimming or paddle boarding. Trying local restaurants, visiting local attractions, and exploring nature are also good ways to explore the neighborhood.

Meet Other Retirees

Start meeting people in Jupiter to feel connected to the community. There is a dedicated website that you can use to stay up to date on all of the senior activities happening in the area. There is something for everyone, from pickleball to self defense and movie watching events, which will allow you to meet other people your age while exploring the neighborhood.

Settle Into Your Home

Focusing on feeling at home quickly can help you transition after your post-retirement move. If you're still looking for your perfect retirement home in Jupiter, explore the home listings from the Orrico Team at Loggerhead Realty. You can contact Dr. Anthony & Adriana Orrico at (561) 707-6188 or email them for more information.

Photo Credit: CDC via Unsplash

If you’re looking to move to the Jupiter area, connect with The Orrico Team today! Dr. Anthony & Adriana Orrico have a deep knowledge of the community and can help you find the perfect place to call home! Reach out today! (561)707-6188

Why You Should Choose Jupiter Start Your Next Business

Recently, more people are choosing Palm Beach County for business expansion, relocation or startups. Business Insider even notes that the ultra-wealthy are arriving en masse to take advantage of the area’s pro-business mentality. As part of this push, the Jupiter area is making strides. Here, people can enjoy the proximity to larger nearby cities, while enjoying the more small-town vibe Jupiter has to offer.

Best of all, Jupiter is a great city for starting a business. If you’re considering relocating your business or starting a new business in Jupiter, the real estate experts at The Orrico Team explain why this charming town should be at the top of your list.

Cost of Living

A more upscale area, Jupiter can be a more expensive place to live, and has a current cost of living score around 124.8. A score more than 100 shows a city has a cost of living above the national average, and if the score is under 100, it means the cost of living is below average. The average median home price is $650,000, and the average rent is around $2,344. That being said, there are plenty of affordable communities in the area such as Sea Palms, Riverwalk and Sea Plum.

Despite a higher cost of living, one can still live comfortably without busting their bank account. There are plenty of low-cost or free activities, grocery stores like Publix are highly affordable, and there is no state income tax in Florida.

Supportive Community

When considering a city, you want to take into account the business communities that can support you and help you thrive as a business owner. Jupiter offers many support organizations can help you get started:

- Resources for Jupiter, Florida Entrepreneurs

- Florida Small Business Development Center

- Palm Beach North Chamber of Commerce

Good Quality of Life

Jupiter is ranked as one of the best places to live in Florida. It ranks very high in the purchasing power index, scores high in the health care index and very high in the climate index. The city is known for great food, wonderful parks and beaches and plenty of great shopping. All these events pull in traffic that directly benefits businesses in the area. Other popular attractions include:

- Jupiter Inlet Lighthouse and Museum

- Major League Baseball Training

- Busch Wildlife Center

- Loggerhead Marine Center

Educational Opportunities

Another reason to choose Jupiter for your business is the presence of educational opportunities, which many residents can embrace to hone their skills. You can easily find skilled labor if you need to hire professionals to help you. Some of the colleges in the surrounding area include:

- Florida International University

- Palm Beach Atlantic University-West Palm Beach

- Florida Atlantic University

- Nova Southeastern University

Resources for Businesses

You need to follow a simple procedure to start a business in Jupiter. First, create a business plan and determine your preferred business structure, whether that’s a limited liability or a corporation. Obtain an EIN Number, then register with the state of Florida to get a state tax ID. From here, apply for a local business license and other permits.

Starting a business is an exciting experience. Choosing the perfect environment to start your business is a critical consideration. Jupiter is one of the best cities in the U.S. if you want to start and run a successful business.

Steps Seniors Can Take to Make Downsizing Easier

Photo via Pixabay

Many seniors face some harsh decisions when they make the choice to downsize their home. It can be a very emotional time, and thinking about giving up the place that brought them comfort for years can be overwhelming. Even if a downsize is necessary and the individual is looking forward to the change, the thought of moving can be a lot to process. Not only that, figuring out what to do with the home is a huge job in itself. There are many options, which can be confusing and can create more work in an already complicated situation.

Fortunately, there are some things you can do to make the process easier on yourself and your loved ones. Creating a plan for the steps you need to take--whether you’re downsizing to a smaller home or to an assisted living facility--will help you avoid any issues down the road so that you can make your physical and mental health a priority.

Here are a few tips on how to decide what to do with your home when downsizing.

Decide how much space you need

When it comes to moving to a smaller home, it’s crucial to think early on about how much space you’re going to have. Having a plan for your belongings is a great way to get the ball rolling because it will help you figure out whether you need to keep some items in storage or ask family members to take them off your hands. Decluttering is a big part of the downsizing process, so go through each room and decide which things you want to take to the new place. If you need a storage unit, note that prices in Jupiter can fluctuate throughout the year. As of right now, the current range of prices for units in Jupiter is $18.75 to $199, based on different sizes.

Learn all you can about the market

The housing market can change quickly, so it’s important to educate yourself about it in your area. Do some research to find out how much homes are going for; this way, if you decide to sell, you’ll know what to expect. It’s also a good idea to find out what buyers are seeking. For instance, if people in your area are shopping for homes that have updated kitchens or new windows, this will help you decide what updates to make and their costs before selling your home. The average cost of replacing windows in Jupiter, for example, is $390.00.

Talk to your loved ones

If you choose to keep the home in your family, as many seniors do, it’s important to talk to your loved ones and let them know about your plans. Open up the conversation about your wishes as they relate to your home and decide who will take over its care. If you decide to leave the home to one individual, it’s a good idea to talk to a lawyer and draw up a will, so there will be no question about your decision.

Find out how to become a landlord

If you want to consider renting out your home after you move, it’s essential to learn about everything that’s involved in becoming a landlord. You might need to make updates to your home or make changes to your property insurance. It will also be helpful to ask a loved one to help you book the property or interview tenants, the alternative is to consider hiring a property manager. Regardless of how you choose to manage your property, renting out your home is a great way to make extra income, and it can even help you fund your move.

Coping with a downsize and everything that comes with it can be a challenge, but it doesn’t have to be stressful. By figuring out which steps you need to take at the beginning of the process, you can remove the most difficult aspects and simply enjoy the newest phase of your life.

WASHINGTON – April 30, 2018 – Freddie Mac is debuting a new 3 percent downpayment option for qualified first-time buyers that could put it in direct competition with the Federal Housing Administration's (FHA) low-downpayment mortgage. The mortgage financing giant announced last Thursday that it's rolling out a new conventional 3 percent downpayment option called HomeOne, which will not have any geographic or income restrictions.

Freddie's expansion into small downpayment loan products for new buyers will put it in competition against FHA, which offers mortgages to first-time buyers that similarly only require 3 percent down.

Freddie Mac rolled out conventional mortgages with 3 percent downpayments more than three years ago for qualified low- and moderate-income borrowers. But it says its HomeOne product won't replace its current Home Possible products; instead, it's designed as a complement to it, Freddie Mac officials say.

HomeOne mortgages will be offered only for conforming fixed-rate mortgages secured by a one-unit primary residence, and at least one of the borrowers must be a first-time buyer. Also, applicants must participate in homeownership education to qualify for the mortgage.

The loan is available for single-family homes, condos and townhomes. Manufactured homes are not eligible.

"Freddie Mac's HomeOne mortgage is part of the company's ongoing efforts to support responsible lending, provide sustainable homeownership and improve access to credit," says Danny Gardner, senior vice president of single-family affordable lending and access to credit at Freddie Mac. "HomeOne is a great solution for aspiring homebuyers to grab that first rung of the property ladder and enjoy the financial and social benefits of participating in homeownership."

HomeOne mortgages will be available starting July 29, 2018.

Source: Freddie Mac and "Freddie Mac Takes Aim at FHA With Widespread Expansion of 3% Down Mortgages," HousingWire (April 26, 2018)

8 Questions to Ask Yourself Before Meeting With Your Designer

Questions to Ask Before Building a New Home

Buying a new home can be a wonderful, creative experience, but it is not without pitfalls. Many preventable problems can arise, which can turn the process into a nightmare. The Orrico Team has had several homes built, and we have helped buyers build many new homes. Please feel free to consult us and let us help guide you the the process. Their is no cost to you for this service!

QUESTIONS TO ASK:

1. Who is the builder and what is their reputation? How long have they been building?

The abilities and experience of the builder will have a significant impact on the quality of the final product. You are spending a lot of money, so you deserve a well-built home. Ask around and talk to several different recent buyers, and maybe even a few other builders or related contractors in the area that will know the work of the builder you are considering. Understanding the builders reputation is one of the most important factors before committing to them.

An important tip when buying a new home:

Ask us about builders. We have been in the area many years, and we have worked with many of them. We won't steer you wrong.

2. What type of homes do they typically build?

Different builders specialize in various types of construction. It makes sense to choose a builder that has a proven ability to build the kind of home you want.

For example, if the builder typically builds economy homes and all of a sudden jumps into selling luxury homes, this is something you may want to think twice about. There is so much that goes into building a luxury home. Building an economy home vs a luxury property are night and day!

3. Do they have other projects going at the moment? If not can you give me some completed project addresses to go look at?

It can be helpful to visit homes they are currently building to see the process they use. At the very least, you should take a look at homes they have already completed to see what the final product looks like.

Checking out other existing projects gives you the opportunity to explore the builder’s craftsmanship. What type of products do they use? What is the level of detail? How neat do they keep their work sites? Does pride show in their work? These are good questions to get answered when building a new home.

4. Who will oversee the construction or my home and who can answer my questions once the building starts?

Just because the owner of the company is experienced and capable does not mean the employees working on your home will be equally capable. There is nothing wrong with asking a few questions about who will be in charge of the building of your home.

You also want to get his or her contact information so you can ask questions when you need to. Lots of builders, however, may not give you their phone number. You will be required to direct all the questions and issues through their real estate agent or building supervisor.

If the building company you are hiring is a large one, it is almost a certainty they will have someone overseeing the day to day operation of their building projects.

5. Are there any special financing incentives for the project?

Many times new home builders will offer special financing to entice buyers. But if you don’t ask about the specials, you may not learn about them. Some special financing packages are really worth looking into. For example, the builder might offer one of the following incentives:

A lower interest rate than the going rate you will find at other lenders.

An extended rate lock at no charge. When building a new home it can often take months to finish the construction, especially if you are custom building. Lenders typically will only lock a rate for 6-8 weeks before they will charge you significant additional fees. Having an extended rate lock when building a new home is a nice perk.

6. What are the standard features in the homes and what are the extras?

Every home builder includes a set of standard features in each home built while offering extras that cost more. Much like buying a car, you want to find out what is standard and what is extra. The scope of is included and what isn’t is one of the most important questions to ask when buying a new home.

The builder should have a detailed “specifications” sheet that details everything that comes standard with your new home. Often times the builder will also have a pre-determined upgrades list that allows you to pick and choose what you would like added to the home and at what cost.

7. Will I have the opportunity to make additional upgrades once the home has started?

Building a home takes time. There is a possibility that you will decide later that you want additional features. It can be helpful to know that you can request upgrades after the builder has started on the home. Some builders will not allow changes to be made after they start construction.

Having this information obviously will be very important. Builders that are flexible with upgrades is also an important consideration. Can you imagine building a custom home where you have decided to change the family room from carpet to hardwood and the builder says, "Sorry too late"?

8. How often and when will I be allowed to tour the home once construction has started?

You should be able to tour the home periodically during construction. However, you most likely won’t be able to wander the work site whenever you like. Talk with the builder to determine when and how often you can tour the home while it is being built.

There are some builders that will be very restrictive when it comes to site visits. You should ask the question up front on how often you will be able to visit your home. After all you are spending a lot of money and of course, are going to be excited to watch the progress.

9. How long will my home take to build and what happens if they don’t make the date?

The builder should have a good idea of how long it will take to build your home, and be willing to explain what will happen if that date is not met. As the buyer, you will need to be somewhat flexible – no one knows exactly what the weather will do in the months ahead – but you have the right to a clear estimate.

The builder’s policy on completion date is one of the most important questions you can ask when buying new construction. There are some builders who have a fantastic reputation for delivering their product on time and others who are downright awful!

You want to have a strong grasp of how closing date issues will work especially if you are buying and selling a home simultaneously. Missing delivery times is one of the biggest complaints against builders. Trust me if the builder doesn’t deliver on time you will be able to find out. The builder reputation will already be suffering for it.

10. Do you offer any energy saving features in your homes?

A new home that is well-built should include a number of different energy saving features. The various technologies related to energy saving materials and features in new homes have come a long way, and continue to improve year by year. Make sure you are getting features that will save you money and reduce your impact on the environment.

One of the hottest trends in building is making the home energy efficient. Look for energy star products supplied by the builder. More builders are building with 2×6 wall vs. 2×4 walls for the added benefit of additional insulation.

11. Are there any differences in cost for the lots?

You will probably have several different lot options. Keep in mind that different lots may have different price tags. You may want to save money with a less desirable lot or get a lot that costs a little more and puts you where you want to be in the neighborhood.

Make sure, however, that you look over the lot premium carefully. Quite often the lot premiums builders assign to their lots do not translate to the value when it comes time to sell. You want a good location but not at the expense of overpaying.

Some of the valid reasoning for charging a lot premium include:

A lot with a walk-out basement which is more valuable given you can have a beautiful living space with natural light.

A better location within the neighborhood.

A larger, flatter or more usable lot.

12. Is there a list of vendors I will need to meet with?

The home builder will use different vendors for different aspects of the home. If you need to meet them, it will be helpful to know about it. You should find out up-front who the vendors are and where their businesses are located.

These are the locations where you will be picking out your selections unless the builder has them on site.

13. When do extras have to be paid? Upfront or at closing?

Sometimes you have to pay for extras up front. Avoid the unpleasant surprise of an expensive bill early on by asking ahead of time. Sound financial planning entails asking the builder how he or she collects their monies for extras. Some will require all of it paid up front, some will allow you to pay at closing and others may ask for half payment.

14. How quickly will punch list items be completed after the final walk through?

You may discover on the final walk through that some things are missing from your home, either due to a mistake or other issues. You want to make sure that the builder will take care of the problems in a timely manner, so you can fully enjoy your new home as quickly as possible. You should make sure you get in writing the completion schedule of the builder.

If there is a major item that hasn’t been completed or is on back order, it makes sense to ask the builder for a holdback of funds to ensure these things will be finalized.

15. Does the home come with a builder’s warranty?

One of the most important questions you can ask when buying new construction is what kind of warranty is included. The warranty offered can vary quite a bit from builder to builder. A builders warranty provides peace of mind, particularly when it comes from the builder. If something breaks early on, you want to know it will be fixed. The typical length of many warranty contracts is a year for all the major components in the home.

16. Will I be able to have a home inspection when the building is completed?

You should be able to have the home inspected when it is completed. A builder, however, is not going to allow you to make your sale contingent on a home inspection. Doing so would be entirely unrealistic. The builder is not going to construct a custom built home only to allow you an escape clause the week of closing. The home inspection should be for informational purposes only.

Picking a professional home inspector, unaffiliated with the builder, will be able to verify that the home is built to current standards. Find your own inspector instead of using one recommended by the builder. We can help you find a dependable professional. Keep in mind that in all major cities and towns the home will need to be approved by all the various city inspectors.

More often than not a home inspection will be more for learning about the major components than anything else.

17. Are there any protective covenants for the neighborhood?

A neighborhood of new homes should have some protective covenants to preserve the value of the properties. You will need to know the covenants that will affect both you and your neighbors. For example, some of the more common protective covenants will be things like:

You can’t raise livestock on the property.

You will not be able to store commercial vehicles like a camper in your front yard.

You will not be able to dramatically alter the appearance of the home without prior approval. This might include the paint color.

You want to make sure you’re not buying into a neighborhood where you will not be able to do what you want to your home!

18. Will there be any homeowners association?

If you will be part of a homeowners association, you certainly want to know about it. The HOA will be responsible for enforcing the rules that are supposed to protect the value of your property and the quality of life in the neighborhood. The quality of your HOA is important because a bad HOA experience can make life much more challenging than it has to be.

19. Can I speak with some of your past clients?

Talking with past clients is important so you can get a clear picture of what it’s like to be a customer. Make sure you talk with at least two or three past clients before you commit to buying from the builder. Most people who have built a custom home with a particular builder will speak freely good or bad about their experience.

Final Recap

As you can see there are a ton of important questions to ask when buying a new home. Building a new home can be an exciting experience or your worst nightmare depending on the builder you choose. Take it from us. We've experienced it many times. Do your homework in advance and more than likely you’ll avoid most of the hassles found in new construction.

Whether You Rent or Buy: Either Way You’re Paying a Mortgage!

First Time Home Buyers, For Buyers, Move-Up Buyers

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

Christina Boyle, Senior Vice President and Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

Bottom Line

Why not give yourself the gift of homeownership? Lock in your housing costs for the next 30 years and guarantee you are the one building wealth.

Our thanks to Joe Speakman for these words of wisdom.

28 Design Ideas Coming to Homes Near You in 2017

How Much It Costs to Keep Up with the Joneses

They’re making a pricey remodeling mistake. You don’t have to.

KEY TAKEAWAYS

The more time you plan to live in your home, the less risk a remodel is.

Scroll to: Is This Your Forever Home?

Very few remodels are worth taking out a loan for.

Scroll to: Are You Tempted to Finance Your Project?

Enjoyment of your home can't be figured into a spreadsheet.

Scroll to: Will Your Remodel Bring You Joy?

Jealous of your neighbors’ new master bath? Who wouldn’t be? It’s got heated floors, a sauna, and a massive whirlpool tub. To be honest, your own bathroom looks like the shower station at the public pool in comparison. And you have been thinking about renovating it. Maybe a sauna isn’t such a bad idea after all. And how about one of those new tube lights? Yeah, that’d be cool.

Actually, doing the opposite — resisting the urge to keep up with the Joneses makes you the smarter neighbor.

Renovating your home into the nicest digs in the neighborhood comes with big risks. Best to think twice before replicating the Joneses’ extravagant additions, lest you end up with an over-renovated house that’s undervalued by the market.

Here are the questions to ask yourself before one-upping the neighbors:

Is This Your Forever Home?

It’s hard to believe, but the average American moves 11.4 times, and according to the data-crunchers at FiveThirtyEight, most 25-year-olds still have more than six moves (!) remaining. So, statistically speaking, you’re going to move.

And you’ll need to sell your house when you do. Which means you should think about how any project will affect your home’s value. It’s not as simple as you think. Just because you improve, doesn’t mean you recoup (more details on that coming up — just watch for the tables).

Some people just want to buy a house and turn it into a giant, English estate. That's your prerogative.

On the other hand, you may truly plan to stay put. Newer studies find that today’s first-time buyers want to stay in their first homes longer than previous generations. So if you’re one of the ones bucking tradition, then by all means, do what you want to do without regard to resale value.

Some people just want to buy a house, and live in it and turn it into a giant, English estate. That’s fine. That’s your prerogative. (Although you might want to look into any homeowner association rules.)

But if you’re planning a move anytime between now and eternity, let the Joneses keep a good lead on you in the renovation race. You’ll come out better financially. Guaranteed.

How Does Your Home Rate?

“You don’t want to be the best house in the neighborhood,” says Las Vegas-based Cristine Lefkowitz Jensen, a REALTOR® and former interior designer. Otherwise, literally every other house around you looks like a better deal. It’s only smart to keep up with the Joneses if everyone on your block does. Keep an eye on comparable properties nearby, and use those prices to know how much is too much to invest in upgrades.

“Don’t put in Carrara marble and $80,000 cabinets in a market that won’t bear that selling price” . It’s just not smart.

If the average home in your area sells for $500,000, and you purchase a fixer-upper for $400,000, don’t invest more than $100,000 — otherwise you’re wasting cash.

Are You Tempted to Finance Your Project?

As a general rule, taking out a loan for a renovation is a bad idea. Any large-scale upgrades that require begging the bank for cash should get an automatic “no” (sorry!). Even if you know for a fact that the Joneses financed their dream bathroom, that’s just all the more reason to march to your own home ownership drum.

Think about it: Even if the Joneses are increasing their home’s value a bit, they’re also paying interest, which eats into the benefit.

That said, don’t feel guilty about financing smaller, low-risk projects that are sure to increase your equity. For example, upgraded insulation may not be sexy, but according to the National Association of REALTORS’® “Remodeling Impact Report,” its median cost is just $2,100, and it recovers 95% of its value in a sale. So a small loan (that you can pay off quickly) might make sense, especially when you consider the energy savings.

Good bets include:

Project Median Cost/Recoup in $$

- New Roofing $7,600 $8,000

- Hardwood Flooring Refinish $2,500 $2,500

- Insulation Upgrade $2,100 $2,000

- New Wood Flooring $5,500 $5,000

- New Garage Door $2,300 $2,000

- New Vinyl Siding $12,000 $10,000

Have You Done Your Research?

Some projects — like refinishing your hardwood — are no-brainers because they’re relatively small and recoup most of their value in a sale.

Other, bigger investments, like updated kitchens, are a big draw for future buyers.

Old, dated kitchens are the number one killer of all deals. According to the “Report,” a typical kitchen remodel costs $30,000 and recovers $20,000 in equity. And no, that $10,000 difference isn’t wasted. You’ll love the upgrades while you live there, and get most of your money back when you move. (And enjoy a shorter selling time, too.)

Here are some popular projects and their typical costs. But a REALTOR® will know what’s ultimately best in your neighborhood.

Project Median Cost/Recoup in $$

- New Vinyl Windows $15,000/$12,000

- New Fiber Cement Siding $19,100/ $15,000

- New Steel Front Door $2,000/$1,500

- HVAC Replacement $7,000/$5,000

- Basement Conversion to Living Area $36,000/$25,000

- Kitchen Upgrade $30,000/$20,000

- Complete Kitchen Renovation $60,000/ $40,000

- Attic Conversion to Living Area $65,000/ $40,000

- New Fiberglass Front Door $2,500/$1,500

- Bathroom Renovation $26,000/$15,000

- New Wood Windows $26,000/$15,000

- Closet Renovation $3,500/$2,000

- New Master Suite $112,500/$60,000

- Add New Bathroom $50,000/$26,000

Another equity-rich option is creating an open floor plan. Not everyone eats dinner like Norman Rockwell, but that’s how the properties were designed at that time. Increase the home’s value by knocking down those walls and adding square footage.

Will Your Project Add Curb Appeal?

Improved curb appeal can increase the price of your home up to 17%, according to a Texas Tech University study, so don’t shirk away from jazzing up your front patio and lawn. So if the answer is “yes,” go with the Joneses on this one.

You only have one chance to make a first impression.

Get a sleek and modern exterior by replacing your crumbling wooden front door with a gorgeous steel model, which looks stunning and recoups 75% of its cost in a sale, according to the “Report.”

Adding trees and bushes brings dimension to your lawn. Even just maintaining your yard makes a big difference. Additional lighting along the walkway is a worthwhile investment, too — in addition to making your home safer.

Will Your Remodel Bring You Joy?

It’s your retreat, your place. It should bring you joy when you walk in the door. You can’t put a dollar figure on the value of that.

However, the “Report” does give some insight into what projects homeowners are happiest with, regardless of cost. REALTORS® asked some of their clients what renovations brought them the most satisfaction.

Here’s how some popular projects ranked, according to the Report’s Joy Score (with 10 being the highest score); and note that “joy” and “recoup” don’t always pair up like you think they would:

Project Joy Score Recoup in %

- New Fiber Cement Siding 10 79%

- Add New Bathroom 10 52%

- Complete Kitchen Renovation 9.8 67%

- New Roofing 9.7 105%

- New Master Suite 9.7 53%

- Hardwood Flooring Refinish 9.6 100%

- New Wood Flooring 9.6 91%

- New Steel & Fiberglass Front Door 9.6 68%

- New Garage Door 9.5 87%

- Kitchen Upgrade 9.5 67%

- New Vinyl & Wood Windows 9.4 69%

- Basement Conversion to Living Area 9.4 69%

- Attic Conversion to Living Area 9.4 61%

- Bathroom Renovation 9.3 58%

- Closet Renovation 9 57%

- New Vinyl Siding 8.9 83%

- Insulation Upgrade 8.7 95%

- HVAC Replacement 8.7 71%

Now you're armed with the facts. Remodel for fun and/or profit!

Thinking of a Major Remodel? Don't Miss This Article!

Dream to Done: How to Refine Your Renovation Vision to Fit Your Budget

Strategies to Make Remodeling a Breeze

Which stresses you out more? The mere thought of adding a bathroom (so many contractors, so many unknowns, and you’re too busy already!) or fighting for Monday-morning mirror time for all eternity?

If it feels like a toss-up, you’re not alone. Remodeling can be overwhelming. With so much going on in your life already, it just feels easier to deal with a home that’s not quite right than to get swamped with one more gargantuan thing, right?

Wrong! A remodel doesn’t have to be so all-consuming. With a few stress-sparing strategies, it’s totally doable — and totally worth it. Use these tips, and you’ll never have to step on your toddler’s rubber duckies while showering again.

1. Start By Making Sure Your Contractor Isn't Overwhelmed

Most homeowners choose summer to do a major remodel because they know freezing temps won’t be a problem. But that also means contractors are super swamped and stressed to the max during summer. Not a good combo for a remodel to come in on time and on budget (not to mention what it’ll do to your blood pressure).

“Working in the summer is a complete nightmare,” says Atlanta-based interior designer Brian Patrick Flynn.”It’s so hot that sometimes there are only certain times of the day people can work.”

Try to schedule your remodel during a less hectic time for contractors. You’d be surprised how much can get done in an off-season. You could also save on costs — a great stress reliever. Woo hoo!

2. Discover Any Quirks That Will Drive You Nuts

We get it. With all the plates you’re currently spinning, skimming online contractor reviews is way more appealing than interviewing references. But this person is going to be inside your house. For days. Maybe weeks! What if his working style is dramatically different than yours? What if the crew drives you nuts? Talk about added stress.

“There might be a thing that’s a huge pet peeve of yours that means you’re not going to work well with that person,” says Flynn.

Ask contractors for references, and chat up the former customers about timeliness, personality, and working style. Does the crew listen to death metal at full volume? Are they all business, or will they pepper you with awkward chitchat? Finding a pro who does great work and is a good fit will take much of the crazy out of your remodel.

3. Look Beyond the Bottom Line of Bids

Just like reading online reviews, accepting your first decent bid may seem like a savvy shortcut, but there’s a reason you’ve heard about getting at least three. The key is to look beyond the bids’ bottom line. A higher estimate can cover solutions to worrisome construction problems like clean up, insurance to cover dented walls, or working at night to fit your schedule. Picking these amenities over a bargain can eliminate some big headaches.

Speaking of headaches, skimping on bid details can cause your temples to throb in another way. Sometimes they don’t include everything. Seriously. Flynn says hidden costs like drop cloths or the installation and removal of scaffolding can make projects go up to 20% or 30% over budget. Be sure to ask if you’ll be responsible for any costs not documented in your bid.

4. Opt for the Pampered Approach

Really want to treat yourself? Or need to, considering your schedule? Get an expert to be the boss instead of you. Overseeing the idiosyncrasies of a renovation can be maddening. Do you have time to educate yourself on the certifications and tests required by projects in rooms with plumbing? When your contractor has a question about a thermostatic valve issue, do you want her calling you for your advice?

“It’s smart to spend extra money to have a true professional project manager,” says Flynn. “If you just pay someone that extra money every week, you don’t have to worry about things you don’t understand.” (Median hourly wage is $46.)

Flynn recommends seeking out and vetting a project manager with experience in your type of project. A good one will save you guesswork that can hold up construction and make you want to pull your hair out.

5. Let the Contractor Handle Permits

Keeping tabs on permit deadlines and booking appointments with historical review boards can feel like a second job for even the most organized homeowner. In fact, it is a job; it just doesn’t have to be yours.

Chip Wade, a home improvement expert and consultant with Liberty Mutual Insurance, suggests skipping the homeowner self-work affidavit (which puts you, the homeowner, responsible for all the liability on the job) and letting your general contractor handle approvals and permits. The small added cost of your contractor’s time will literally take things off of your to-do list.

6. Stay on Schedule by Setting Benchmark Deadlines

Nothing makes for a low-stress remodel like staying on schedule. Your contractor should be willing to create benchmarks at the beginning of the project. Sticking to them? You’re going to want to keep an eye on that.

Typical benchmarks include demolition, framing, electrical, inspections and the like. Share a calendar with your contractor (a digital one like Google calendar is super convenient, but an old-fashioned paper one will work too) and check in as benchmarks creep up.

Why bother? Wade recommends intervening once two of these benchmarks are missed. One missed benchmark still allows contractors to make up time. Two is when the timetable (and budget) could derail — creating that sinking feeling you’ve worked so hard to avoid.

7. Control the Money

The more motivated your contractors are, the less harried you will be. Paying in small installments as work is done can discourage a strong finish and result in sloppy work.

The typical recommendation is to pay no more than 10% up front. But Wade recommends a 50/50 split with the contractor, assuming you’ve done your homework and your contractor is a reputable one — and it’s legal to do in your state (California, for example, has a law saying you can’t put down more than 10%). Fifty percent is more than a contractor typically gets for a down payment, which is a benefit to him. But have the contract specify that the remaining 50% will be paid upon completion, which is the benefit to you because it motivates him to finish the job to collect the rest of his money.

If that option isn’t open to you, another way is to offer bonuses, which is what Flynn’s project managers do. On tight schedules, pros who hit benchmarks before their due dates receive a bonus (the amount varies depending on scope and difficulty).

“They see an opportunity to make an extra few bucks, and it always works,” says Flynn. This can be the push your pros need when your guest bath needs to be ready before your in-laws arrive for a lengthy Thanksgiving weekend — without you spending your valuable time begging and pleading (and stressing) to make it happen.

Another, easier way to find a good contractor is to ask us for a referral.

You can call or text us, or click on the Home Maintenance button on the left side of our website Home Page and fill out an email form. We'll steer you to the right person.

Our thanks to Eliziabeth Lilly and Houselogic.com for this article.

Easy Fixes for That House You Want to Buy

Find out the common flaws that shouldn’t be deal-breakers — and a few that should give you pause. Based on a Houzz.com article.

From price and location to the physical structure itself, the list of things to keep in mind when shopping for a house can seem endless. But some problems you encounter don’t need to affect your final decision. Although easy is a relative term, accomplishing the 10 fixes that follow is generally pretty straightforward. We also point out some big-ticket fixes to watch out for. Happy house hunting!

1. Easy fix: Repaint or reface existing cabinetry. If the interior structure of the cabinetry is still sound, refinishing, repainting or refacing (replacing the cabinet fronts) can be a more cost-effective way to refresh a dated kitchen than completely replacing the cabinetry. If the cabinet doors are in poor condition or you want to change the style, consider refacing.

2. Easy fix: New appliances. Swapping out old appliances for shiny new models is one of the biggest-impact ways to make over your kitchen without getting bogged down in a full remodel. And because the cost of appliances and installation is pretty straightforward, it’s easier to plan and budget for this upgrade than projects that might expand beyond your original scope.

Not-so-easy fix: New kitchen layout. Replacing what’s already in your kitchen is one thing, but when you start to move the plumbing and electrical around, costs can rise quickly. If possible, go for a house with a kitchen that has a layout you’re happy with — you can always tweak the details.

3. Easy fix: Fresh carpeting. Stained, worn-out carpeting is a real bummer, and it can be hard to see past it when viewing a potential home. But ripping out old carpeting and putting in something new — especially something as fresh and fun as the colorful carpet tiles shown here — can make a huge difference in how a space looks and feels.

4. Easy fix: New paint color. It’s amazing the effect color can have on us — remind yourself of this fact the next time you tour an open house with some (ahem) unusual color choices. You can easily (and cheaply) replace any wall color with a beautiful hue, like the lovely silvery blue shown here.

5. Easy fix: Replace light fixtures. Swapping out dated light fixtures with new ones you love is a quick and easy fix an electrician or DIY-savvy homeowner can accomplish in relatively little time. From modern pendants (like the saucer version shown here) to Edison-bulb chandeliers, there’s a light for every style and taste.

Not-so-easy fix: Extensive electrical work. Exchanging one light fixture for another in the same spot is simple; updating old or unsafe systems is another matter entirely. Electrical work should definitely be left to the pros, and electrical repairs in an older home can cost a pretty penny, so be sure to get a thorough inspection and review it in detail.

6. Easy fix: Repurpose a room. Just because a room is shown as a messy kids’ room or workout space doesn’t mean that’s what will make the most sense for you. As you tour potential new homes, think creatively about the spaces you see and try to imagine your own furniture in them. One person’s overstuffed home office could be your perfect sun room.

Not-so-easy fix: Adding on. Remodeling costs get a whole lot bigger whenever you talk about changing the footprint of a home, so try not to be seduced by talk of how “easy” it would be to tack a room on to the back of the house. Although there are always exceptions, your best bet is usually to find a house with a footprint you can work with.

7. Easy fix: Remove or cover up popcorn ceilings. Not much dates a house like the lumpy, bumpy texture of a popcorn ceiling. Thankfully, fixing it isn’t too complicated, and you’ll soon have a nice, smooth ceiling. The most common method is simply scraping it off, but if there’s any chance that lead and-or asbestos might be present in the paint or the popcorn material itself, you’ll need to cover it up with drywall instead.

8. Easy fix: Add architectural interest. If you love the look of older homes with lots of original architectural details but haven’t been able to find the right one at the right price, it’s still possible to get some of the detail you crave, even in a newer build. Crown molding, baseboards, picture rails and even built-in features like bookcases and bench seating can be added by a carpenter to give a boxy new build added character. It’s an extra cost, but it’s not especially difficult, and it can make a big difference in how you experience a home.

9. Easy fix: Refinish floors. If you’re lucky enough to spot a house with real wood floors, don’t let a dull finish turn you off. While engineered hardwood can usually be refinished only a few times during its life (the number depends on how thick the veneer is) solid hardwoods can take a lot more, so you can have gorgeous, glossy floors (or artfully beat-up floors if you desire) for years to come.

10. Easy fix: Add landscaping. Yard looking a little bare? Adding landscaping, whether a simple DIY job or a landscaping pro’s design and installation, is something that can make a huge impact on curb appeal and, more important, how you feel when you come home each day.

Top 10 Trending Bathroom Photos

3 Ways to Buy Real Estate with a Small IRA

With the popularity of Real Estate IRAs gaining ground, it’s important to stay up to date on this topic. It can be an excellent wealth-builder for you, or it can dramatically improve your lifestyle. If you have a small (i.e, too small for the whole purchase) IRA, there are a few paths you can follow.

Here are the three most popular ways for a buyer with a small IRA to invest in real estate:

1. Partner the IRA

A self-directed IRA or Real Estate IRA can partner with other IRAs, investors’ money, and even personal funds. Sometimes partnering with one account, one investor, or only yourself, will not provide enough funding for the investment you are interested in. In this case, you can partner with a group. The IRA would own a fraction of the investment and share the profits and expenses with other investors in that same proportion.

2. Leverage the IRA

Yes, your IRA can take a loan. The regulations require a non-recourse loan if a loan is to complete a real estate transaction in a self-directed IRA. A non-recourse loan is a loan in which you, as the IRA holder, are not personally liable for repaying the loan. The IRA holder cannot personally guarantee the loan the IRA is acquiring. Once you locate a lender/bank, the lender will lend to your IRA, not to you as an individual. The lender will have no recourse against you or other assets in your IRA in the event of a default. The lender will only be able to recover the property and your equity in the property that has the loan.

3. Lend your IRA

You can passively invest in real estate by providing capital from your IRA for a real estate transaction. In many cases we see investors borrow from a third party’s IRA to close on a transaction. The IRA owner determines the rate and terms of the loan. The loan from the IRA is secured by the property.

Help leverage the wealth that lives in your IRA today. Consider a real estate IRA. Check with your tax advisor before doing so.

Our thanks to Jason Craig of the Entrust Group for this timely information.

How People Upgrade Their Main Bathrooms, and How Much They Spend

Frugal Ways to Help Your Bathroom Sell Your House

(excerpted from Houzz.com)

As with the kitchen, the bathroom is always a high priority for home buyers. Here’s how to showcase your bathroom so it looks its best

Buyers love the allure of a fresh, beautiful bathroom that reminds them of luxury hotels or soothing spas they have enjoyed. And, most important, buyers want to envision themselves enjoying this luxury every day in their new home.

However, the reality is that most of us do not have the perfect bathroom. And we know that, in most instances, it is not a wise investment to do a full, costly renovation just for a home sale. It simply doesn’t translate into profit.

A better strategy is to maximize what you already have, on a budget. You want to transform your real-life, everyday bathroom into a five-star hotel experience that prospective buyers will love, without overcapitalizing. Here are simple ways to create havens with a wow factor.

1. Clear off the counters to create a blank canvas. Remove all of your everyday toiletries and bathroom supplies. This includes soaps, toothbrushes, cotton balls — everything. (And don’t forget the products in the shower.) Buyers do not want to see your personal hygiene products. In fact, this can make them feel as though they are intruding on your personal space, which can be distracting and a little awkward.

2. Get rid of cleaning products. Remove all items that imply housework and maintenance, such as toilet brushes, wastepaper baskets, sponges, cleaning products, bath mats — even spare toilet rolls. These are a necessary part of everyday living, but they do not create a beautiful spa-like experience for your buyers.

Tip: Remove the bathroom scale, too. Remember, your buyers want a luxurious bathroom experience, not a reminder of those extra pounds they are trying to lose.

3. Maximize your storage. Storage space sells. Your buyers will be looking inside your bathroom cupboards to see how much space they offer. Make sure they are only half to two-thirds full and well organized. Store the little things you use every day (hair elastics, lip gloss) in a pretty box or basket with a lid to avoid a tidal wave of trinkets on the shelves.

Tip: If you’re running out of space to store your toiletries, keep the overflow in simple wicker baskets. When buyers are coming to inspect your home, just grab the baskets and stash them somewhere else.

4. Make minor upgrades. Rather than spending many thousands completely renovating your bathroom, it’s much smarter to spend your money only where it will show and to make small, inexpensive upgrades that will create a large impact. As a general rule, improvements that can’t easily be seen don’t translate into a higher sale price.

The best bang-for-your-buck bathroom upgrades are: repainting the walls, replacing leaking and worn taps, updating the cabinet hardware, installing new light fittings and updating towel bars.

Note: In some bathrooms it’s also worth considering changing the tiles (large white tiles always make a bathroom feel more spacious and contemporary), replacing shower screens and investing in new cabinetry and countertops. This is often warranted in a higher-priced property, where buyers are looking for (and expecting) a higher level of bathroom luxury.

5. Clean thoroughly. Clean everything to within an inch of its life. No, it’s certainly not exciting, but it’s super important. Buyers will pay a premium for new, so your aim is to create a new feel. Everything must be immaculate, as this creates the impression that your home has been well maintained and well loved.

6. Hang luxurious towels. Any bathroom can be instantly transformed by adding beautiful, soft towels. New is best (once towels have been washed, they never look quite the same). So it’s a great idea to keep your new towels just for display only. Pack them away between buyer inspections and reinstate them just before the prospective buyers arrive.

Tip: If there is a lot of extra counter space, you can also place a neatly folded pile of two or three matching towels on the vanity or side of the bath for extra luxury.

Thick, white, luxurious towels always work well, and there are some beautiful textured options. Funky, brightly colored towels are popular at the moment too; for a more dramatic effect, you could consider adding a splash of bold color.

7. Stick with neutrals. If you are going to repaint your walls, upgrade your tiles or invest in new cabinetry, it’s always a good idea to keep to a neutral palette for these larger elements, as it will appeal to more buyers. If you want to add some fresh color, use towels and accessories.

8. Beautify with accessories. Now that you have cleared away your personal bathroom products, bring in a few well-chosen accessories to add a layer of warmth, elegance and luxury. Think about creating a spa-like experience with accessories in tranquil, soft colors. Include fragrant soaps, bath oils, natural loofahs and candles.

It’s important to display these products as groupings rather than scattering them around the room; scattered products can look like clutter. Less is better. Think simplicity. You may want to consider using a wooden tray as a base and group items together in odd numbers. Vary the height of candles and jars, too.

9. Use flowers for impact. Fresh flowers and plants make any space come alive, and the bathroom is no exception. They make a dramatic impact, adding instant color and texture. Orchids are always a favorite in bathrooms; however, here’s no need to always buy huge bouquets. In a smaller room, a single stem of your favorite bloom, a small planter or even a branch with beautiful leaves placed in a jar will look understated and elegant.

10. Add a stool or an ottoman. To create the ultimate private-hotel-suite look for your buyers, add a beautiful decor piece that is functional as well. Put a stool beside the bathtub and add neatly folded face and hand towels, soap, a candle, potted plants or even a good book. You could also use other beautiful occasional pieces of furniture, such as a marble side table, a long ottoman stacked with fresh towels or a bamboo ladder, to add extra style and take your room to another level.

Check out a great video of the Jupiter Inlet area at https://www.youtube.com/watch?v=DNdfhIq3dAo

Ownership Benefits Go Beyond ‘cheaper than renting’

PITTSBURGH – July 20, 2015 – Clinique Brundidge rented apartments in several cities over the past 13 years as she built her career as a material scientist. Like many young adults, the 31-year-old senior scientist at Bechtel Marine Propulsion Corp. in West Mifflin, Pennsylvania, didn't think much about the thousands of dollars she handed over to landlords.

Then she sat down one day two years ago and added it up.

"I'd spent $130,000 on rent during that time," Brundidge said. "It was sort of going into a black hole. … That was the turning point."

With rents rising faster than home prices in many cities, and interest rates at historic lows, many renters could buy a house and lower their monthly payments. But experts say that shouldn't be the only consideration in deciding whether to rent or buy.

"It's not just about whether that monthly payment is bigger or smaller," said Daren Blomquist, vice president of RealtyTrac.

Building equity

How long you plan to live in the house, the downpayment and closing costs, and unexpected maintenance expenses are important to factor into the choice, which is often the biggest financial decision in someone's life.

Cost was a key consideration for Brundidge. The money she paid in rent over the years was roughly the same as the average price of a home in Allegheny County – $132,000. She also wanted to lower her monthly housing payments.

Brundidge closed on the purchase of a three-bedroom rowhouse in Pittsburgh's North Side last week for $240,000. But the mortgage payment is about the same as the $1,450 a month she paid in rent for an apartment in Monroeville, she said.

She gets a home of her own and will build equity, rather than help pay off someone else's mortgage.

Set priorities

Lou Stanasolovich, CEO of Legend Financial Advisors Inc., said young adults should consider financial priorities before jumping into homeownership, such as having an emergency fund and putting money into a retirement account.

"We encourage our clients to have a minimum of three months' expenses in reserve," Stanasolovich said. "That is simply, in a young person's case, to address the layoff possibility."

He suggests putting a minimum of 10 percent of gross income into a retirement fund. "Then we can start talking about a house and saving money for a downpayment."

Up-front costs

Low-downpayment loans, at 3.5 percent of the purchase price, increasingly are common. But it's not the only money a homebuyer will need up front.

Closing costs – fees paid to the lender, agent and closing company, along with taxes and other charges – can range up to 5 percent of a home's purchase price.

Timing

With such large up-front costs, it's important to live in the home long enough to take advantage of the lower mortgage payments, Blomquist said. "If you're going to be in the home for less than five years, you may want to stick to renting."

It would take nearly eight years to recoup the $10,560 needed to buy an average-priced Pittsburgh home that's $113 a month less expensive than renting. Staying in the house longer would build equity as the mortgage is paid down, Blomquist said.

Maintenance

It doesn't matter how new and perfect the house is – things break. The furnace dies, pipes leak, and shingles get blown off roofs. Those repairs and maintenance can quickly add up to thousands of dollars, Stanasolovich said.

"All that is worth something in the neighborhood of $2,000 to $5,000 a year," he said.

New homeowners should have a few thousand dollars in savings at the time of purchase, Blomquist said. "At the closing table, you shouldn't be walking away with your bank account completely drained."

Brundidge said her home was recently renovated, including appliances, roof and furnace. She purposely chose a property with a small yard to reduce maintenance.

"I do plan on getting an extra savings account to put aside money … just in case something happens," she said.

HOW TO CLEAN HARDWOOD FLOORS

Gleaming wood floors are a thing of beauty. Here’s how to keep them that way.

Although installing hardwood flooring is usually more expensive than rolling out new carpet, it’s an investment worth considering, according to data from the National Association of Realtors. Surveys show that 54 percent of home buyers are willing to pay more for a house with hardwood floors. The question now: What’s the best way to clean and care for that popular flooring and keep that natural beauty (and value) shining through? Here’s how.

It’s not the wood — oak, maple, mesquite, bamboo, engineered hardwood or something more exotic — that determines how the floors should be cleaned, but rather the finish.

Surface finishes, often referred to as urethanes or polyurethanes, are among the most popular treatments today and are usually applied to hardwood floors after installation to protect them and make them more durable and water resistant. These finishes create a protective barrier. There are four types of surface finishes, according to the American Hardwood Information Center: water based, oil based, acid cured and moisture cured.

Homes built before 1970, including historic residences, may have original wood floors that were sealed with varnish, wax or shellac. These require a different approach to cleaning. The American Hardwood Information Center says these types of finishes work by penetrating the wood to color the planks and form a protective shield. Using a wax coating after staining provides a barrier against wear and tear and gives the floor a beautiful low-gloss satin sheen. The classic look requires a little extra TLC, however, since water-based products and mopping can damage the finish.

HOW TO DETERMINE YOUR WOOD FLOOR FINISH

To figure out whether or not your wood floors are finished with a polyurethane, shellac, wax or varnish, or have a finish that has worn away and is no longer providing coverage, the American Hardwood Information Center suggests these tests:

- Run your hand over the wood. If you can feel the texture of the grain, the floor has a “penetrating” finish (usually a combination of a natural oil, such as linseed or tung oil, mixed with additives for drying) topped with wax.

- In an out-of-the-way spot, dab on a little paint remover. If the finish bubbles up, it is a surface finish, like polyurethane, which coats the floor in a protective layer.

- In an out-of-the-way area, place a few drops of water. If the water beads up and does not soak into the wood, the finish on the floor is intact. If the water is absorbed into the floor or leaves a dark spot, the wood is unfinished or the protective layer has worn away.

- If you sprinkle on a few drops of water and white spots form beneath the droplets after about 10 to 15 minutes, the floors are sealed with wax. To remove the white spots, use a piece of fine steel wool lightly dampened with wax and rub gently.

- If you suspect a varnish or shellac, take a coin and scratch the surface of the floor in an inconspicuous corner. If the floor has been sealed with one of the older finishing methods, it will flake off.

Not wearing shoes in the house is one of the best ways to significantly reduce dirt, scuffs and daily wear and tear, and lessen cleaning time.

The National Wood Floor Association, or NWFA, is more specific and warns against walking on wood floors with cleats, sports shoes and high heels. It also offers this cautionary example: A 125-pound woman walking in high heels has an impact of 2,000 pounds per square inch. Furthermore, an exposed heel nail can exert up to 8,000 pounds of force per square inch.

Whether you got out your calculator or not, the possibility of impact and denting appears to be undeniable. However, while you can’t always ask guests to shed shoes at the door, it might be a policy worth considering for family members.

No matter what type of wood flooring you have, the NWFA advises against using cleaning products meant for vinyl or tile flooring. Their take: Self-polishing acrylic waxes cause wood to become slippery and appear dull quickly.

Another no-no: wet-mopping wood floors, since standing water can dull the finish, damage the wood and leave a discoloring residue. Along the same lines, avoid overwaxing unfinished wood floors in an attempt to restore luster. If a waxed floor has become dull, try buffing the surface instead.

Cleaning floors with contemporary polyurethane wood finishes (for floors installed after 1970) starts with vacuuming, sweeping or dust-mopping the surface.

Vacuuming. Vacuum wood floors daily, or at least once a week with a vacuum fitted with an attachment for wood floors. For regular machines, the American Hardwood Information Center advises turning off interior rotating brushes or beater bars if possible.

Regular vacuuming helps remove dust and dirt particles that play a leading role in scratching and dulling the surface of the floor.

Sweeping. The American Hardwood Information Center says choosing a broom with “exploded tips,” also known as synthetic fiber ends, is step one.

Damp mopping. Damp mopping should be done with a simple solution of pH-neutral soap (like dishwashing soap) and water; or one capful of a mild cleanser such as Murphy Oil Soap in a bucket of water; or a solution using products specially formulated for wood floors, such as Bona, Eco Mist Colloid W, Dr. Bonner’s or Method.

In conscientious cleaning circles, controversy swirls around whether to use a mixture of vinegar and water for damp-mopping wood floors. Ultimately, everyone has to do what works best; however, within the past 10 years this method has lost favor, and popular belief now holds that the solution causes floors to dull more quickly and is not as effective as simple soap and water.